First, the rule of investment is to invest with money that you don’t use temporarily. This rule is the principle of all investment and financing behaviors。

If you want to invest, be sure to use the money you don't use temporarily. Even if you lost the money, it will not have a substantial impact on your life.

If the money is used to buy a house, get married, or pay for your children's tuition, and this money has a clear purpose, you won't bear any losses. Then you should put this money in the bank, and never invest in some seemingly magical financial products.

Once you break this rule, it's hard to keep a good attitude to face the market, because you can't afford to lose. Many people use the money that is used to buy a house to buy P2P before marriage, which makes their life more difficult.

The problem you need to solve now is make money, instead of thinking about how to study investment and finance. The limited time and energy should be used for more important things.

Second, the three core principles of investment and financing are security, liquidity and profitability.

The most important one is security, which represents the possibility of your comeback. As long as the capital is safe and the principal is still available, there is still a chance for everything.

This is the simplest but reliable strategy to cover risks. If you stick to this strategy, at least you won't lose all.

The second important one is liquidity, which is the ability to realize assets.

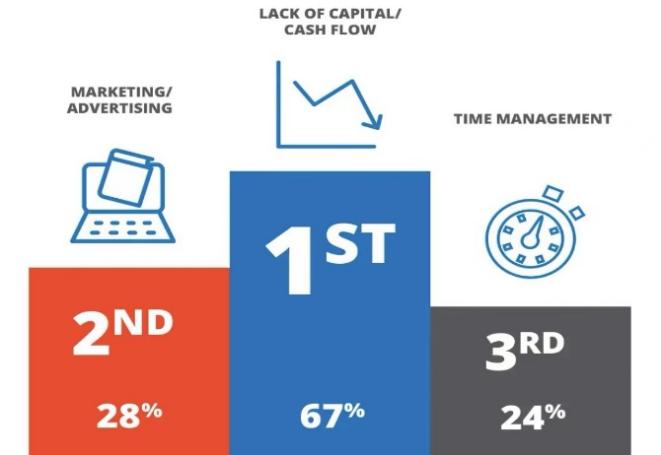

Real estates can't save you when you need money most, but 1 million cash can. Pay attention to the liquidity of investment. Cash flow is the life of an enterprise, and profit is just fat. More or less is irrelevant, but cash flow cannot be interrupted.

The same is true for individuals.

The least important of the three elements is profitability, because it is only the difference between earning more and earning less. As long as the capital is safe and flexible, earning more and earning less will not affect the overall situation.

In real life, many people look at the importance of the three principles upside down. They only look at profitability rather than liquidity and security, which is why many obvious scams can deceive people. Because the income is high enough to break the values and stimulate people's greed.

Controlling greed is an important lesson in our life, not limited to investment.

Third, investment should be risk diversification, and do not focus on a single target.

Don't put eggs in the same basket. This is a good saying. It is an effective means to control risks by dispersing funds to different investment targets.

But the problem is that many people have a problem with their perception of risk diversification.

What is risk diversification? You put part of your money in the stock market, part of your money in bank financing, part of your money in bank deposits, and part of your money in funds. This is called risk diversification.

Fourth, don't make an investment you don't understand.

This is a very important principle. In fact, many people don't know what they are investing in. They only know what they are investing in, such as strong strength, high yield, high-tech, and future trends. As a result, when they ask for technical details, they are full of questions.

If you don't know what you are investing in, you won't know how people cheat you when they cheat you. You need to clearly know the principle of the product, and then judge whether it is cost-effective.

Top 3 Car Insurance Providers for Young Drivers in 2024

Diversifying Your Stock Portfolio

Financial Strategies for Millennials: Current Trends and Future Predictions

Choosing Commercial Insurance: Life or Wealth?

Same - Sex Partners: Unmarried Financial Strategies

Money's Journey: From Yu'E Bao to Funds

Access Global Markets: Investing in Foreign Stocks Made Simple