People are reconsidering their financial plans as a result of the COVID-19 pandemic's impact on global economies and financial environments. Financial stability and growth in the post-pandemic economy depend on our capacity to adjust to new standards. To assist you in navigating these changes and setting yourself up for future security, this blog article offers practical advice.

Reassess Your Financial Goals

Many people have had to reconsider their financial objectives as a result of the epidemic. if you're saving for retirement, a child's education, or a house, it's critical to evaluate if your objectives still fit your present situation.

Tip: Evaluate and modify your financial objectives in light of your evolving personal and professional circumstances. Based on your current situation and your goals for the future, set both short-term and long-term goals. Make sure these objectives are still relevant and attainable by reviewing them frequently.

Build and Maintain an Emergency Fund

The epidemic highlighted the need of having a strong emergency fund. Unexpected occurrences, such as job loss or medical issues, can occur suddenly, making it critical to maintain a financial buffer.

Tip: Set aside three to six months' worth of living costs in a conveniently accessible account. Begin modest and progressively expand your savings, contributing regularly despite other financial obligations.

Diversify Your Income Streams

Relying only on one source of income may be problematic, especially in unpredictable economic times. Diversifying your income can help you maintain financial security and expand your options.

Tip: Look into side hustles, freelance employment, or investing in passive income sources like rental properties or dividend stocks. Evaluate your talents and interests to identify opportunities that fit your lifestyle and financial goals.

Reevaluate Investment Strategies

Market volatility during the pandemic underlined the need of having a well-thought-out investing plan. Making educated financial selections is critical in today's fast changing market.

Tip: Diversify your portfolio across asset types to reduce risk. Consult a financial counselor to go over your present investments and change them based on market circumstances and your risk tolerance. Keep an eye on developing sectors that might prosper in a post-pandemic society.

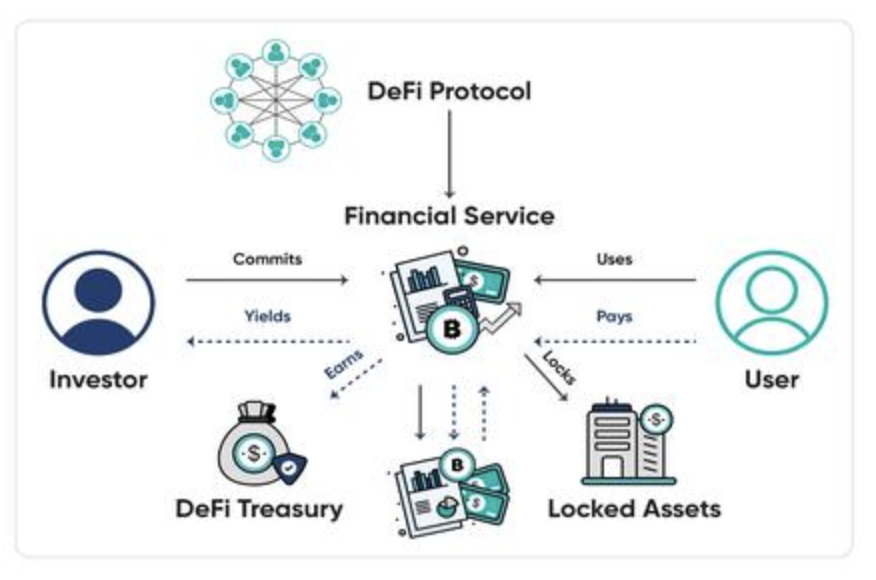

Embrace Technology and Digital Finance

The epidemic has boosted the use of digital finance tools, ranging from internet banking to investment applications. Embracing these technologies can help you improve your financial management and offer up new prospects.

Tip: Get acquainted with digital tools that include budgeting, saving, and investment options. Use applications and internet services to track your financial health, conduct transactions, and evaluate your spending habits. Be wary of cyberattacks and use renowned platforms with robust security features.

Prioritize Health Insurance and Financial Protection

Health and financial security have become critical during and after the epidemic. Having appropriate coverage might help you avoid financial hardship in the case of a medical emergency.

Tip: Review your health insurance coverage and, if necessary, consider adding extra insurance. To protect your family and income, think about getting life and disability insurance. Update your insurance policy on a regular basis to account for changes in your needs and circumstances.

Conclusion

As we navigate the post-pandemic economy, adjusting to new financial standards is critical to ensuring our financial security. You may face the difficulties and possibilities ahead with confidence if you evaluate your goals, establish an emergency fund, diversify your income streams, fine-tune your investing strategy, embrace digital finance, and prioritize financial safety. These tactics will not only help you build resilience in difficult times, but will also set you up for future growth and success. Remember that financial planning is an ongoing process, and being educated and adaptive is critical to success in the changing economic world.

The Future of Financial Services in the Age of Big Data

Maximize Miles, Points & Cashback

Wealth Safety in Uncertain Times: Strategic Guardrails

How to Leverage Behavioral Finance for Smarter Investments

Arbitrage Rebellion: Beating Consumerism at Its Game

2025 Crypto: Where Are the Opportunities?

Protecting Investments During Volatility