The two basic goals of social investing are the impact on society and the

environment, together with financial advantages. Investing in companies is that

contribute positively to society while aligning investments with investor ideals is

known as socially responsible investing. Read below for a quick guide on how to start socially responsible investing.

Discover Your Values and Goals

Define your values and how you'd like investments to impact the world. Of course, socially responsible investment intersects well with environmental sustainability, human rights, corporate ethics, or perhaps a mix of all that interests you. That can certainly set clear goals for guiding investment decisions.

Do you want to avoid particular industries, such as tobacco or fossil fuels, or do you want to positively promote an industry's support, like clean energy or good labor

practices?

Financial Objectives: You can now integrate your "force for good" mission into achieving your financial objectives. SRI hopes to generate robust financial

performance for you while allowing you to align your capital with companies that have sound business practices and the use of natural resources that are beneficial to

society.

SRI Investment Choices

There are several ways of going about it as a particular investor in individual equities or funds. The three most common SRI investment vehicles are:

Socially Responsible Mutual Funds: These are funds that invest in companies

passing multiple ethical and ESG checks. They offer diversification with professional management, hence the easy option for beginners.

-ETFs:ESG: focused ETFs track indexes of companies with good ESG ratings. That is a very low-cost way to have an easy exposure to a company that is socially

responsible.

Individual Stocks: If you enjoy being a little more hands-on, you can cherry-pick from independent companies with agendas to help your cause.

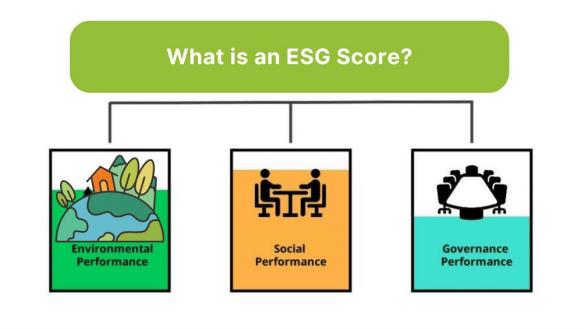

Understanding ESG Ratings and Scores

Of course, to be sure you invest in really responsible companies, you need to check the companies' ESG ratings. Independent agencies rate a corporation's conformity to environmental, social, and governance standards.

Third-Party Rating Providers: Companies like MSCI, Sustainalytics, and Morningstar can give you ESG ratings to understand a company better.

Know What You're Getting: Ratings differ by provider, so know how your rating was determined and make sure that it reflects your values or morals.

Diversify Your SRI Portfolio

Like any investment strategy, diversified methods help to reduce your chance of all risk for unrestrained returns. Building a diversified portfolio with diversified socially

responsible assets can help you meet this balance.

Sector Diversification: Invest in companies from different sectors, such as technology, healthcare, and renewable energy to scatter risk.

Geographic Diversification: You invest in local and international companies that meet your ESG requirements.

Track Your Investments

To that end, you ought to maintain monitoring the performance of your investments since you have established such a socially responsible investment portfolio. SRI is a long-term strategy, and ESG ratings related to companies can change with time due to changed practices or external shocks.

Monitor Changes in ESG Practices: The policies of companies change, or they are taking part in unpopular practices, and you’re ESG ratings changed. Monitor updating activities by ESG rating agencies.

Financial Performance: However, by fixing on social responsibility, a commitment to monitoring financial performance is still required to ensure your portfolio meets your long-term needs.

Go on Impact Investing

It is a branch of SRI, which selects an investment consciously for both measurable

social or environmental impact in addition to its financial return. In contrast,

mainstream SRI programs have shunned, nay, been instructed not to invest in companies whose activities harm society.

Thematic Impact: Thematic investors concentrate on particular themes, such as affordable housing, clean energy, or sustainable agriculture.

Use a Financial Advisor

If you are a new investor of where to start when building your SRI portfolio, you will benefit greatly from meeting with an experienced financial advisor in socially

responsible investing. That advisor will guide you to the best investment opportunities and help ensure that your portfolio embodies both your values and your financial

goals.

SRI Expertise: Investment advisors who are well-exposed to ESG and impact investing can help educate clients on the specifics of socially responsible

investments.

As you diversify your portfolio, you should remain true to what brought you there in the first place: a set of core values. Market trends are going to tempt you to keep your investments in companies with great performance but those that do not meet your ethics standards. Keeping your credos and balancing your financial goals

against your overall will be what keeps you going for the long haul with socially responsible investing.

Conclusion

What has made socially responsible investing so attractive is its ability to allow you to invest with your values while still making money. You will be contributing to society without risking your financial security. Provided you do your research and continually monitor, then yes you will even be able to amass wealth responsibly through SRI.

Consumerism Trap: Why More Spending = Less Wealth?

Credit Card Mastery: Strategic Rewards

Enhancing Personal Financial Wisdom Through Market Volatility

Is Uber Stock Worth Buying? Could It Be a Potential High-Return Investment?

Financing Multi-Family Properties: Opportunities and Challenges

Financial Health of Young Adults: Digital Banking's Role

Why Smart Investors Choose Non-Real Estate Assets