For individuals who are new to managing finances but have significant spending capabilities, deciding how to allocate income is more than just trimming expenses; it's about wisely distributing funds to harmonize enjoyment with long-term growth. Rather than sticking to strict guidelines like “50/30/20,” let’s create a more adaptable plan that suits your way of living.

Focus on Essential Growth Investments

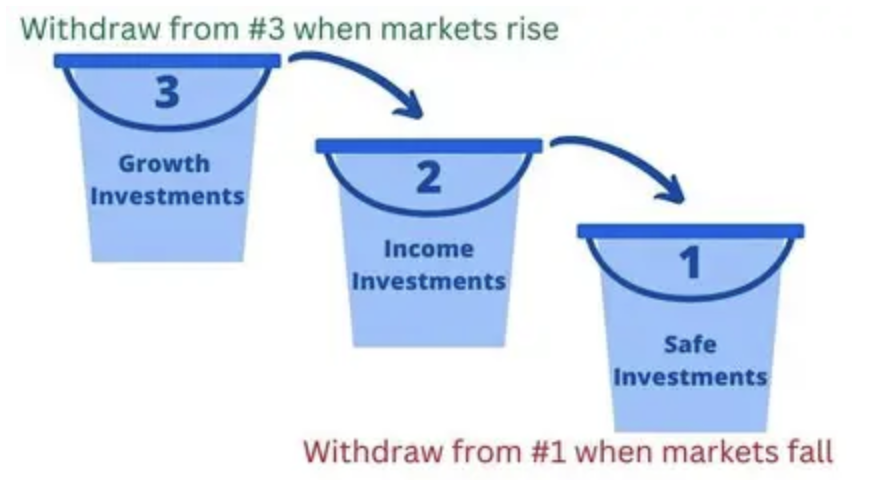

Start by designating a part of your income towards assets that appreciate over time, rather than merely shoving it into savings accounts. Consider investing in low-risk index funds or dividend-yielding stocks. This approach isn't about a quick path to wealth; it's about constructing a safety net that grows, ensuring you don't depend entirely on future earnings.

To enhance this growth, combine these main investments with some investments in sectors that may have higher potential related to long-term trends, like renewable energy or healthcare innovation. However, ensure that most of your money stays in stable options to prevent too much risk. Additionally, reinvesting the dividends from your stocks helps speed up your growth. Over ten years, even small annual returns of 4-5%, when reinvested, can greatly increase your portfolio's worth through compounding, transforming regular, small investments into a significant savings fund.

Set Aside Funds for Enjoyment

You put in a lot of effort, so reserve a section of your budget for pleasures that truly make you happy—be it a luxurious holiday or an expensive hobby. The trick is to determine this amount beforehand, allowing you to indulge without feelings of guilt and steer clear of impulsive purchases.

Consider your "enjoyment fund" as an essential component of your budget, similar to savings or investments. Aim to allocate 5-10% of your disposable income for this purpose, modifying the percentage to fit your financial objectives. For instance, if you're working towards buying a house but still want to indulge in fine dining, designate a specific monthly budget for gourmet meals rather than avoiding them or splurging unexpectedly. This approach enhances your overall quality of life and encourages you to stay committed to your long-term financial goals since you are still enjoying the benefits of your efforts.

Maintain a Liquid Cash Reserve

Besides preparing for emergencies, keep some cash on hand for unexpected opportunities: a rare investment, a professional development course, or even a startup idea. This fund empowers you to grab chances without upsetting your financial plans.

Consider Overlooked Lifestyle Expenses

People with high incomes often miss recurring expenses that can easily slip their minds, such as subscriptions, memberships, or maintenance costs for premium items. Commit a specific amount for these expenses to prevent them from depleting your growth or luxury budgets.

Instead of aimlessly spending, channel funds into experiences that elevate your quality of life or expand your network—like specialized workshops, industry conferences, or personal tutoring. These expenditures can yield benefits in your career or personal growth over time.

Review Your Budget Every Three Months

Your circumstances evolve, so assess your allocations quarterly: Is your growth fund performing well? Did your luxury fund enable you to enjoy the experiences you wanted? Adjust percentages as needed to keep in line with your objectives. By centering your focus on growth, enjoyment, opportunities, and overlooked costs, you can transform income allocation into a strategy that nurtures both your current lifestyle and your future security.

What is a mortgage refinance?

Why the Wealthy Choose Insurance for Inheritance

Investment 101: Stocks, Funds, Bonds

Emergency Funds & Insurance: Dual Financial Safeguards

Algorithmic Wealth Management: Fact or Fiction?

5 Clear Signs It’s Time to Upgrade Your Car and How to Secure the Best Auto Financing Deal

The Four Golden Rules of Options Trading: Precisely Grasping Market Pulse