If you want to manage family finance, you must know the monthly income and expenditure of a family, so that you can know how much money can be used to invest.

If you already have a certain amount of savings, understanding the family expenditure and expenditure rules will help you understand how much of your savings is used as petty cash, and the rest can be used for financial management without worrying about taking it out for emergency.

Maybe many people think that high income can bring a sense of security, so they desperately pursue high salaries, which is understandable. But in fact, bringing a sense of security is from a reasonable income structure not high income.

Because no matter how much you can earn now, if most of the income structure is active income, once your company or personal health have any problems, and now the seemingly stable family financial situation will collapse soon.

The age of 35 to 45 is the peak period of a person's labor value. If the family income structure cannot be gradually changed at this stage, it is inevitable to go downhill.

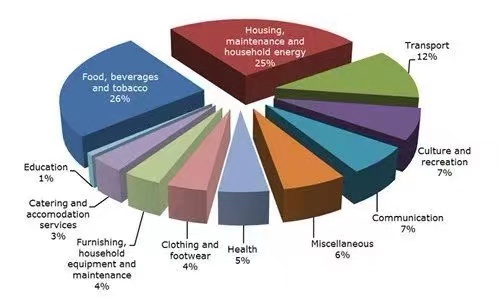

Family expenditure is divided into fixed expenditure and flexible expenditure. Which expenditure items are unnecessary and which can be reduced? These questions need you to think carefully.

Only in this way can we gradually increase the cash available for financial management and gradually increase the proportion of passive income. Remember, flexible spending is the only part you need to focus on and control.

After you sort out the income and expenditure cash flow statement, you can clearly know the maximum amount of flexible expenditure that you can spend each month every year.

If you want to have more money to manage your finances, you must reduce flexible spending as much as possible.

You can set a reasonable monthly consumption budget for the relatively large items in the elastic expenditure, such as dining out, cosmetics, clothing, tourism and other items.

Nowadays, many young people seem to live a rich life under the temptation of various consumer loans and installment payments. If we do not change the consumption mode and get rid of the life by stages as soon as possible, it will be difficult to have savings after getting married, and there will be no money for financial management.

After sorting out the family financial situation, the next step is to save money. Save your first 1000, 10000 and 100000 dollars to lay a healthy foundation for family finance.

Controlling expenditure does not necessarily reduce the quality of life. The purpose of throttling is to better open source.

Only by controlling the money saved by flexible expenditure can we slowly increase the proportion of passive income and form a healthy income structure.

Remember, a person who does not know how to control his desire will never be financially free.

On this basis, do a good job in family security, understand the basic structure of the financial market, and understand some basic financial products, such as bond funds and stocks. Understand the risk return characteristics of different asset classes and what is called asset allocation. With more financial knowledge as reserves, we can go further and further on the road of financial management.

Small-Cap vs. Large-Cap Funds: Where Should You Invest?

Credit Evaluation: Banks' Hidden Methods

Budgeting in Uncertain Times

Maximizing Your Social Security Benefits: What You Should Know

Ethical Banking: Banks with a Conscience

Financial Harmony: Institutionalizing Family Finances

The Ethical Framework for Investing: Juggling Profit and Values